Facts About Kam Financial & Realty, Inc. Revealed

Facts About Kam Financial & Realty, Inc. Revealed

Blog Article

The Ultimate Guide To Kam Financial & Realty, Inc.

Table of Contents7 Easy Facts About Kam Financial & Realty, Inc. ExplainedThe Basic Principles Of Kam Financial & Realty, Inc. The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking AboutThe Ultimate Guide To Kam Financial & Realty, Inc.Rumored Buzz on Kam Financial & Realty, Inc.Some Known Incorrect Statements About Kam Financial & Realty, Inc.

When one takes into consideration that mortgage brokers are not required to submit SARs, the actual quantity of mortgage fraudulence activity could be much greater. (https://leetcode.com/u/kamfnnclr1ty/). Since early March 2007, the Federal Bureau of Examination (FBI) had 1,036 pending home loan fraudulence examinations,4 compared to 818 and 721, specifically, in both previous yearsThe bulk of mortgage fraudulence falls under 2 wide classifications based on the motivation behind the scams. normally involves a consumer that will overemphasize revenue or asset values on his/her monetary declaration to certify for a loan to buy a home (mortgage broker in california). In much of these instances, assumptions are that if the revenue does not climb to fulfill the settlement, the home will certainly be sold at a revenue from recognition

Getting The Kam Financial & Realty, Inc. To Work

The vast bulk of fraudulence instances are found and reported by the institutions themselves. Broker-facilitated fraud can be fraudulence for building, fraud for earnings, or a mix of both.

The adhering to stands for an instance of fraud for profit. A $165 million area financial institution determined to enter the home mortgage financial company. The financial institution acquired a tiny home mortgage company and worked with a knowledgeable mortgage lender to run the procedure. Nearly 5 years right into the connection, a capitalist informed the bank that several loansall originated through the very same third-party brokerwere being returned for repurchase.

Some Known Facts About Kam Financial & Realty, Inc..

The bank alerted its primary federal regulatory authority, which after that got in touch with the FDIC due to the potential influence on the bank's economic problem ((https://www.slideshare.net/luperector). Further examination disclosed that the broker was working in collusion with a home builder and an evaluator to flip residential properties over and over once again for greater, bogus revenues. In total amount, even more than 100 financings were stemmed to one contractor in the same community

The broker refused to make the payments, and the instance entered into litigation. The bank was at some point granted $3.5 million. In a subsequent conversation with FDIC supervisors, the financial institution's president indicated that he had actually always listened to that one of the most challenging component of this article mortgage financial was seeing to it you implemented the appropriate bush to offset any kind of passion rate run the risk of the financial institution may sustain while warehousing a considerable volume of home loan.

Kam Financial & Realty, Inc. Fundamentals Explained

The bank had representation and guarantee stipulations in agreements with its brokers and assumed it had choice with regard to the finances being originated and offered via the pipe. Throughout the litigation, the third-party broker argued that the bank should share some duty for this direct exposure because its internal control systems ought to have acknowledged a lending concentration to this neighborhood and instituted procedures to prevent this threat.

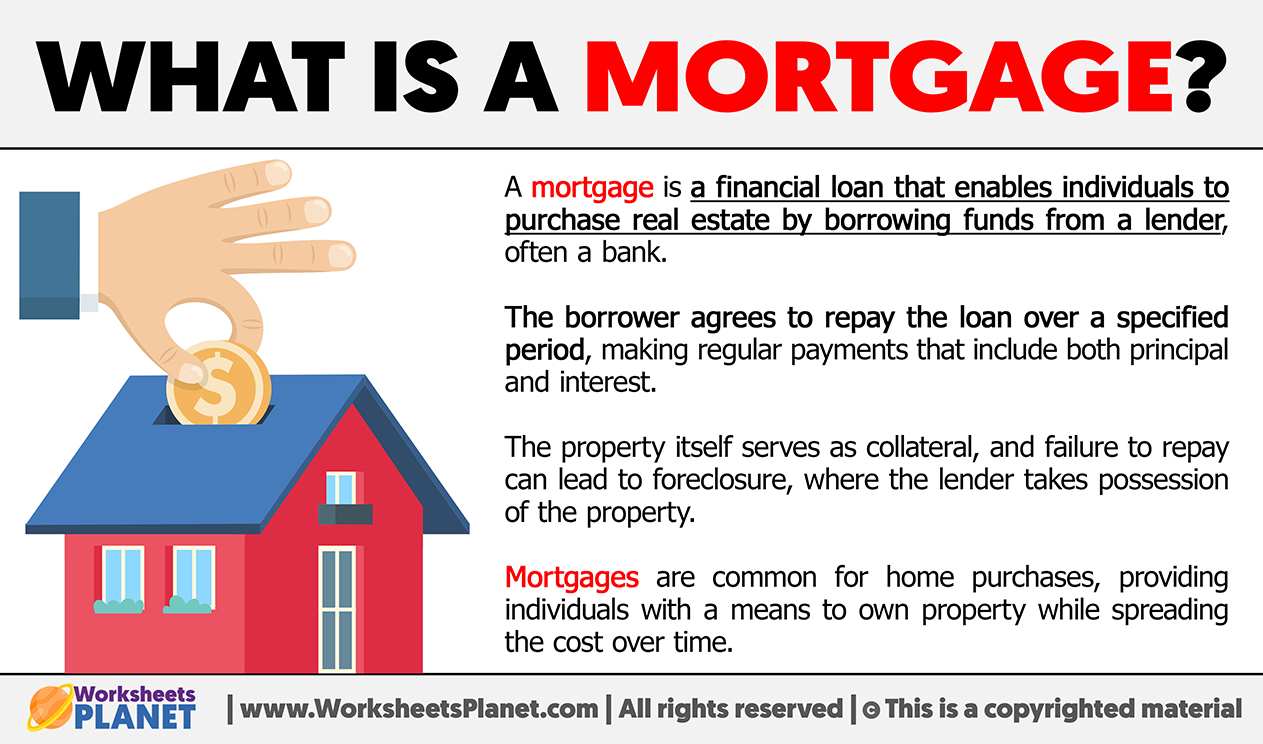

What we call a regular monthly mortgage settlement isn't simply paying off your mortgage. Rather, assume of a monthly home mortgage payment as the four horsemen: Principal, Rate Of Interest, Residential Property Tax, and Property owner's Insurance (called PITIlike pity, because, you understand, it enhances your payment).

Yet hang onif you think principal is the only total up to think about, you 'd be ignoring principal's friend: rate of interest. It would certainly behave to assume loan providers allow you borrow their money simply since they like you. While that may be true, they're still running a company and desire to put food on the table as well.

Examine This Report about Kam Financial & Realty, Inc.

Interest is a percentage of the principalthe amount of the financing you have actually delegated repay. Interest is a portion of the principalthe quantity of the car loan you have left to pay back. Home loan rate of interest are regularly transforming, which is why it's smart to choose a home loan with a set rates of interest so you recognize just how much you'll pay every month.

That would indicate you 'd pay a tremendous $533 on your very first month's home loan payment. Obtain ready for a little bit of math below.

Some Known Incorrect Statements About Kam Financial & Realty, Inc.

That would certainly make your monthly home mortgage repayment $1,184 every month. Monthly Principal $1,184 $533 $651 The next month, you'll pay the very same $1,184, but less will most likely to interest ($531) and much more will most likely to your principal ($653). That fad proceeds over the life of your home mortgage until, by the end of your mortgage, almost all of your settlement approaches principal.

Report this page